Your Money. Your Move.

Next-level Digital Banking for desktop and mobile devices.

With Citizens Bank’s suite of online and mobile banking tools, you can bank your own way – from anywhere, anytime. Manage accounts and pay bills with just a few clicks on your phone or computer. Easily set spending controls and receive instant alerts for your debit Mastercard®. Go paperless with eStatements. Breeze through in-store and online checkouts with a digital wallet.

Getting Started

If you have an existing username, you can log in to the new desktop platform using the Login button at the top of the page and follow the login instructions on the right. After logging in, remember to update your bookmarks/favorites..

If you’re new to online banking, click “Log in,” then click “Enroll,” and follow the prompts.

To get the updated app on or after 11/18, search for CitizensBank24 in the App Store or Google Play, then follow the First-Time Login instructions on the right.

First-Time Login Instructions

-

On the login page, select “Forgot Password.”

If you’re new to online banking, click “Login”, then click “Register for Digital Banking” and follow prompts. -

Review the disclosure, check “I agree,” and click continue.

-

Enter your existing Bank-By-Net username. Verify your identity by following the prompts. When asked for an account number, use any complete Citizens Bank account number. If you don’t have or can’t remember your account number, call us at the number below and we can help.

-

Choose your preferred method to receive a temporary passcode and click continue.

-

Enter the one-time passcode you received and select verify.

-

Create a new password that meets security requirements.

From here, you will complete your login process and view your accounts.

Your Finances. Simplified.

We’re making some big upgrades to your desktop and mobile banking experience. Brand-new features will include:

Take a Tour

Learn your way around our enhanced platforms with these quick video tutorials.

With Online Banking you can:

- Get up-to-the minute account information

- Transfer funds between accounts

- Make payments on Citizens Bank loans or credit lines

- View front and back digital images of your cancelled checks

- View and download checking and savings account statements

- Export your account info into programs like Microsoft Money or QuickBooks*

With Online Bill Pay you can:

- Pay as many bills as you want

- Control when bill payments are scheduled

- Enter, edit, or delete payments 24/7

- Pay merchants that accept electronic payments with rapid transfers

- Pay other merchants with an automatically prepared and mailed paper check

*Some fees may apply.

With CitizensBank24, you have instant access to your accounts wherever you go.

Smartphone users can enjoy the convenience of our iPhone and Android apps, and customers with a web-enabled phone can access the interface with their browser. And, as always, you’re protected by cutting-edge security technology when you bank with Citizens.

With CitizensBank24 you can:

- Check account balances

- See recent transactions

- Transfer money between accounts

- Electronic Bill Pay

- Pay bills

- Set up new vendors

- Make deposits with EZ Deposit Mobile* (Apple and Android apps only)

- Find your nearest Citizens Bank ATM or branch (Apple and Android apps only)

- Manage your Debit Mastercard(s)®.

- Turn your debit card on and off

- Set spending limits based on dollar amount, transaction type, merchant type

- Set specific regions where the card can and can’t be used

- Set parental controls and monitoring

- Get instant alerts on specific types of transactions

How to download the app:

Search CitizensBank24 in Google Play or the Apple App Store, or you can download the latest and most convenient version for Apple or Android devices here***.

* Deposit limits and other restrictions may apply.

** Most smartphones and web-enabled mobile phones can be used with our mobile banking service. Mobile banking use is subject to the terms and conditions of the Citizens Bank Online Banking Agreement and Mobile Banking Agreement.

*** Your wireless service provider may charge additional fees for data usage and text messaging. Consult your wireless provider for details.

Our free Bank-By-Phone and Bank-By-Text options make your everyday financial management even easier.

Want a fast way to access account information, perform transactions, and make payments right from your landline or mobile phone without the need for an app? Bank-By-Phone makes that possible.

With Bank-By-Phone, you can:

- Check account info

- Transfer funds

- Make loan payments

- Manage your debit card

Just call our toll-free line at (877) 543-8745.

To report a lost or stolen debit card, increase daily debt card limit, or report travel plans, call (866) 882-2265.

With eDocuments, you don’t have to worry about snail-mail slowdowns or archiving paper files. Your statements, notices and tax documents are easily downloadable and available on your Digital Banking eDocuments portal for up to 36 months*. eDocuments are highly secure with our use of the latest encryption technology and fraud prevention software. eDocuments are also mobile friendly; allowing you to size them to your mobile device for best visibility.

How to get started:

- Log into Digital Banking in either the desktop or mobile app

- Navigate to Accounts

- Navigate to eDocs

- Click View Documents

For information on how to navigate in the eDocuments portal, click the About eDocs tab.

*Statements and notices will be archived up to 36 months. Tax documents will be stored up to 12 months.

Pay the easy way online and in stores with a Digital Wallet.

With a Digital Wallet, your payment and shipping information is conveniently stored in your mobile device. You can load your Citizens Bank Debit Mastercard® and/or Citizens Bank Credit Card(s) to make fast tap-and-go payments at any merchant with enabled terminals and within participating mobile apps for Apple and Android.

Choose from several options including:

- Apple Pay®

- Google Pay™

- Samsung Pay™

How to get started:

Click here for complete instructions, FAQs, and links to download the Digital Wallet that’s right for you.

Upgrade FAQs

We’re working to make this transition as fast and seamless as possible. Here’s what you need to know:

We are upgrading our mobile and desktop banking platforms to provide you with new and improved features and a faster, smoother experience. It will be easier than ever to manage your money from home, at work, or on the go.

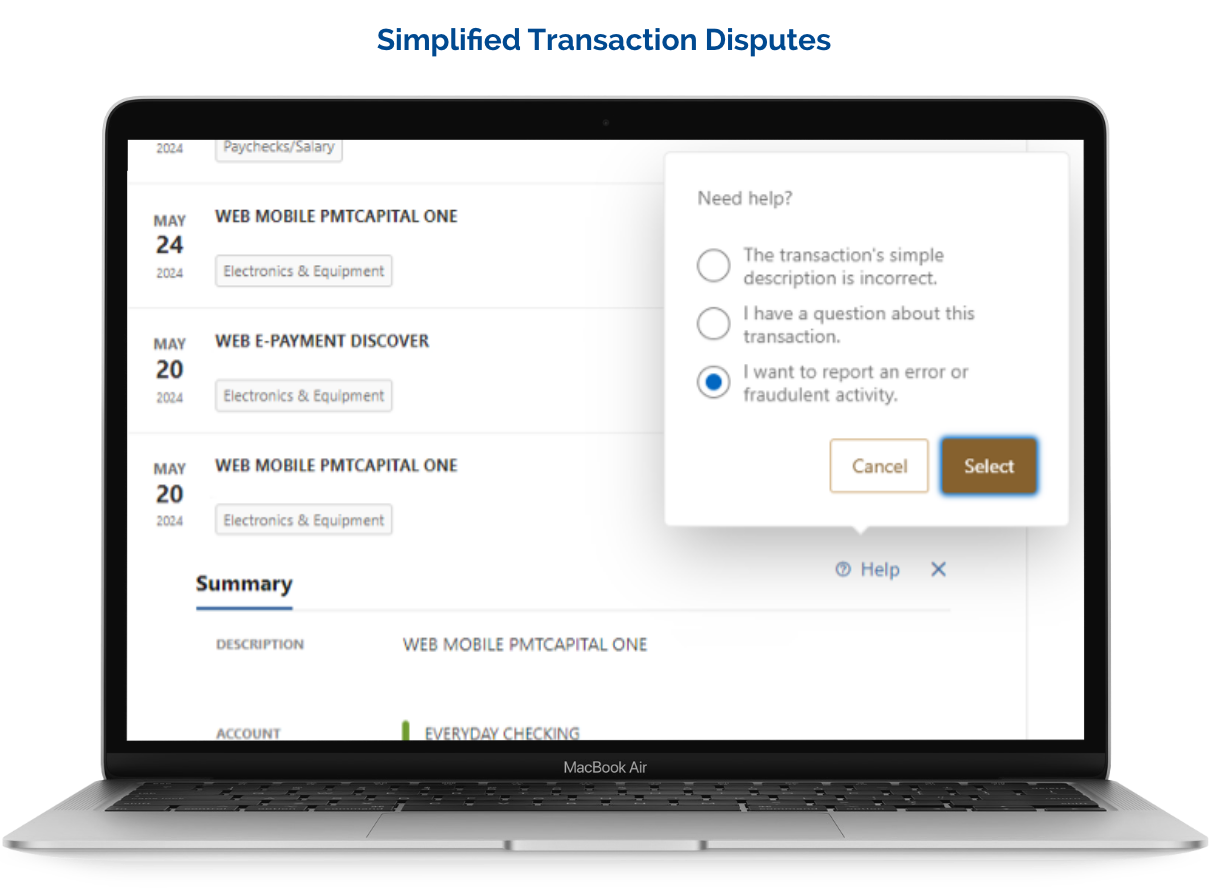

New and improved mobile and desktop banking features will include:

- Digital ID + Authentication

- Spending Insights

- Personalized Goals

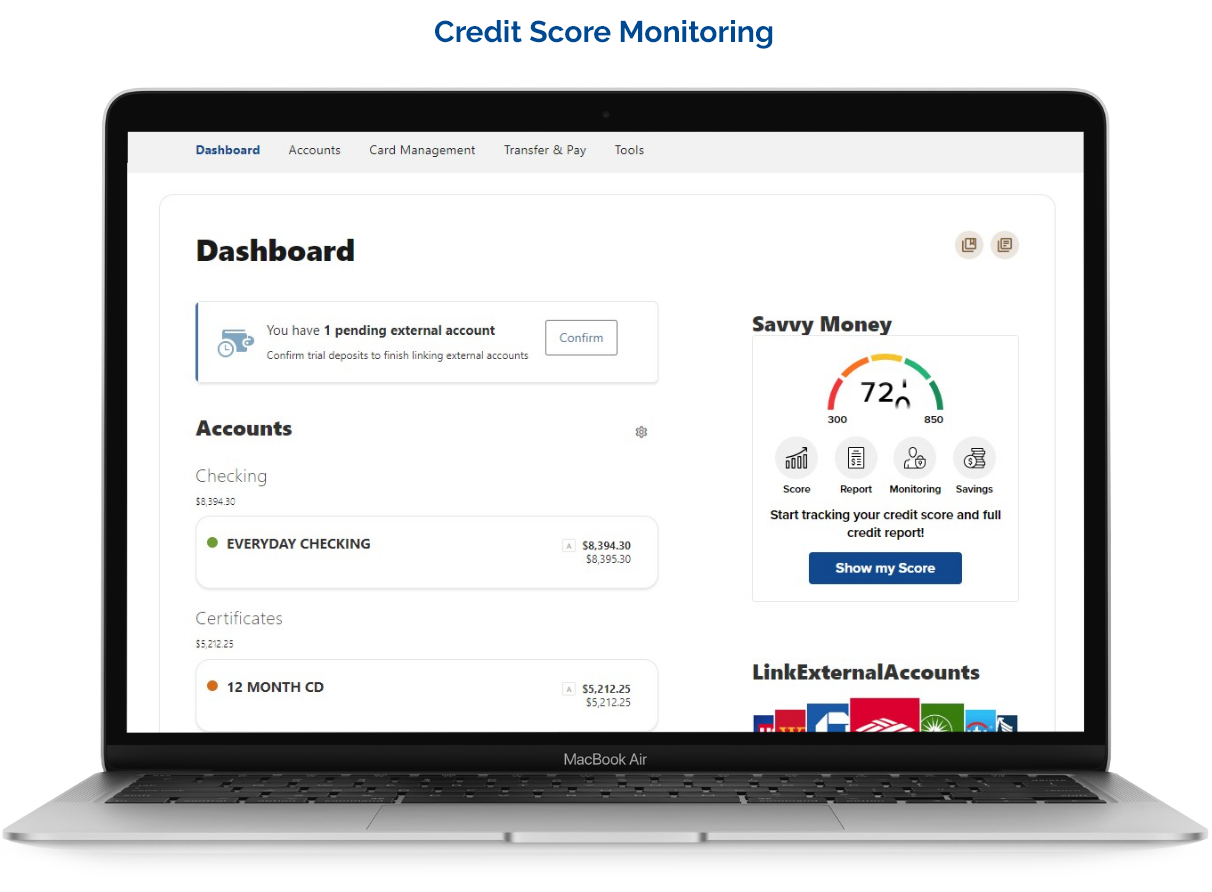

- Credit Score Monitoring

- Personalized Loan Offers

- Online Account Opening

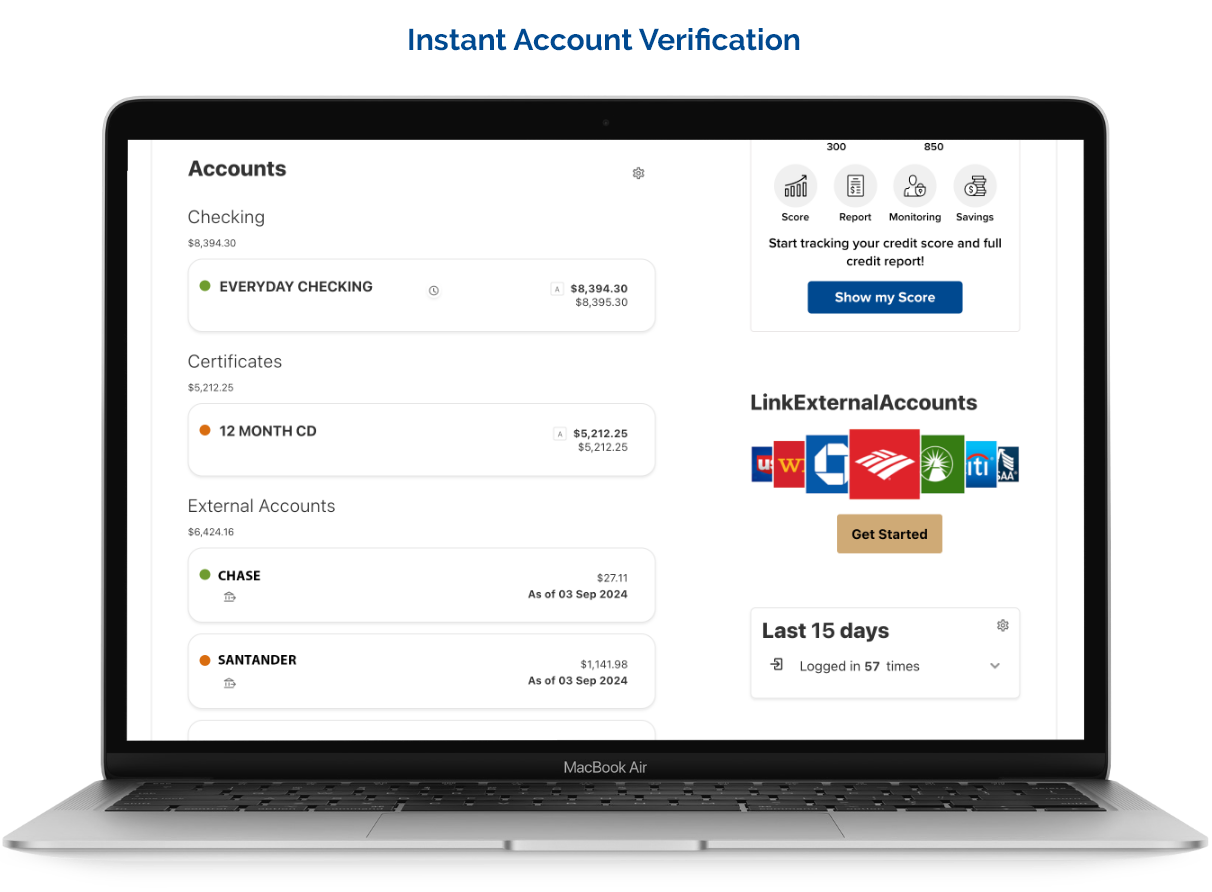

- Instant Account Verification

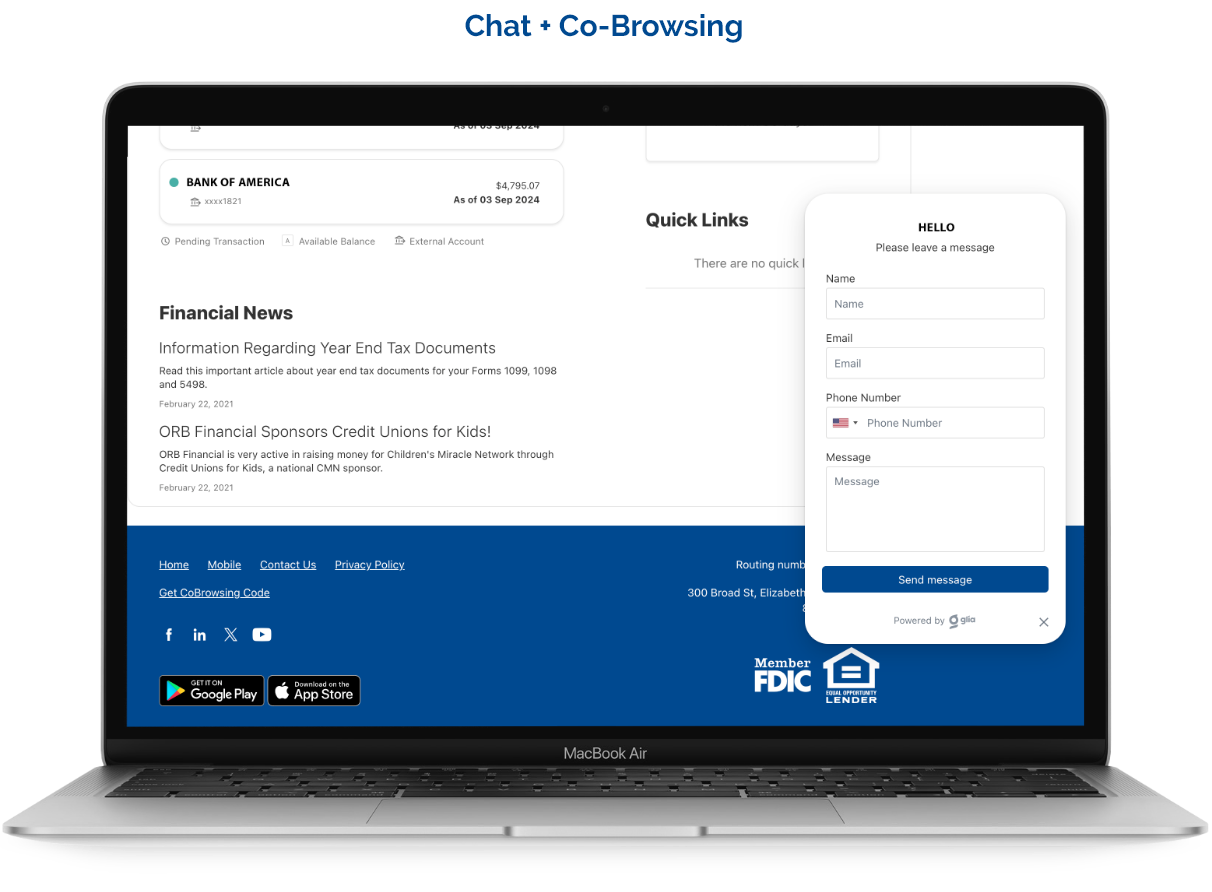

- Chat + Co-Browsing

- Debit Card Controls

- Transaction Data Cleansing

- External Account Linking

- Flexible Payment Options

Once the platforms are live, Android users will need to download the new mobile app from Google Play. The app will automatically update for iPhone users. Please note that the old mobile app will stop working when the upgrade takes place.

Once the platforms are live, you will be able to log in to the new desktop banking platform from our homepage or a direct link. Please remember to update your browser bookmark, as the URL will be different.

If you’re an existing user, you will not need to re-enroll in mobile or desktop banking. You may be asked to re-register for a service.

You will be able to use your current username. You will update your password by using the Forgot Password link.

Your account numbers will not change. If you added nicknames to your accounts, you will need to re-add them.

You will have access to 24 months of account history. Your eStatements will be available from February 2023 onward. If you need earlier statements, please let us know.

If you received notices electronically, they will be mailed to you temporarily but will become available electronically at a later date.

If you have scheduled one-time or recurring transfers to occur after November 15th, those will carry over to the new Digital Banking. However, we encourage you to verify that your transfers carried over after November 18.

You will have access to at least 24 months of loan payment history. If you need to confirm earlier transactions, please let us know.

All direct deposits will continue processing as usual.

For Bill Pay users, all of your existing payees and scheduled bill payments will transfer to the new Digital Banking service. However, you will not have access over the conversion weekend and access to the Bill Pay service is expected to resume on Tuesday, November 19.

Also, any bill you have scheduled to pay during this weekend will process and be paid. You do not need to re-schedule any bill payments.

Check back for updated information.

Need Help?

Call our team at 866-882-2265 or click ![]() in the lower right-hand side of your screen to send us a secure message.

in the lower right-hand side of your screen to send us a secure message.